Emerging Crypto Projects to Keep an Eye on in 2024

Written on

Innovative Projects in a Bear Market

Instead of dwelling on the challenges faced this past week in the crypto space, let's broaden our perspective. While recent events haven't been pleasant (and you're likely aware of the reasons), it's essential to look at the bigger picture. Cryptocurrency isn't going anywhere—especially with significant players like Blackrock proposing a Bitcoin ETF, luxury brands such as Louis Vuitton and Nike venturing into NFTs, and Sotheby’s auctioning off a record-setting NFT for $5 million!

The emergence of new projects is the clearest indication of crypto's resilience. The continued passion and commitment from individuals dedicated to its development ensure that the industry remains vibrant.

Restaking: A New DeFi Paradigm

How does restaking fit into this narrative? Eigen Layer is introducing a novel DeFi primitive.

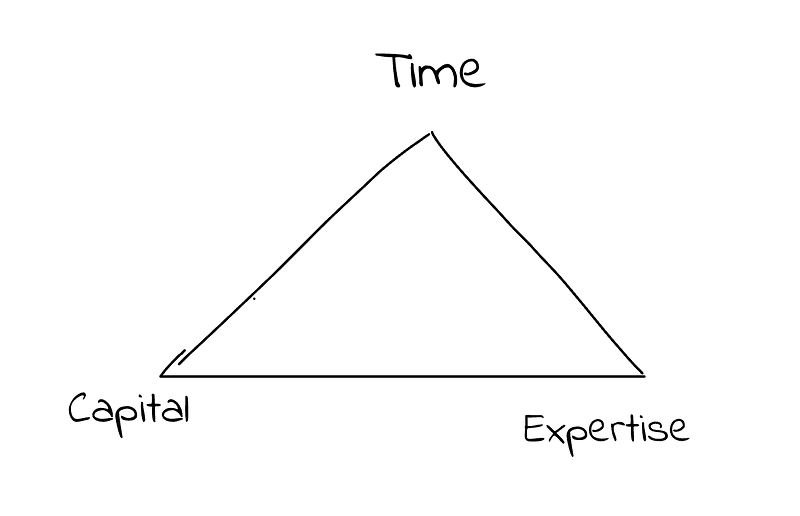

Restaking allows users to maximize their already staked Ethereum. This isn't merely about increasing yield—it's about enhancing security and promoting decentralization. While yield generation is certainly appealing, the crucial aspect is the efficient use of capital. Like traditional finance, crypto thrives on economic incentives.

Typically, securing new protocols or layers requires new capital, which can be a daunting task as projects multiply. The inefficiency of spreading resources thin can hinder the decentralization and security of new initiatives. Not every user has the expertise or resources to establish a new validator, and often, the incentives simply aren't compelling enough.

EigenLayer aims to tackle this challenge. Having initially tested on the Goerli network, they have recently launched on the Ethereum mainnet, enabling users to stake their LSTs, ETH, and native staked ETH.

This new approach capitalizes on the commitment of ETH stakers, who are generally in it for the long haul. ETH is becoming a safe haven asset, so why not leverage this capital pool for additional purposes?

The concept of restaking is still in its infancy. Vitalik Buterin has cautioned against excessive speculation, as risks remain under scrutiny. The complexity introduced by adding layers to the already intricate beacon-chain staking could pose challenges. However, there's potential for restaking to ignite the next "DeFi summer," seamlessly aligning with the future of app chains and rollups.

As we face the reality of Ethereum's struggles with mass adoption, app developers may require their own layers or rollups. Instead of creating entirely new networks, they could utilize Ethereum's consensus mechanism at a reduced cost.

Shaping the Future of Gaming: Argus Labs

Argus Labs is taking significant strides to address the shortcomings of crypto gaming. The company's CEO has expressed frustrations with the limitations of blockchain infrastructure for gaming, and they've set out to create a solution.

The initial forays into crypto gaming were experimental, but the 2021 bull market revealed the inherent flaws in blockchain gaming. The infrastructure was originally designed for finance, not gaming.

Argus Labs aims to overcome these limitations by creating a sharded blockchain tailored for gaming. Dubbed "The Game Engine," this framework allows developers to build their own games with essential compatibility and functionality, including smart contract frameworks and integration with traditional game engines like Unity and Unreal. Developers can use Golang, eliminating the need for Solidity expertise, which opens the door for non-crypto developers to create blockchain games.

Their vision encompasses maximum creative freedom, novel gameplay mechanics, interoperability across various games, and scalability for large player bases. In essence, they aspire to create a multiverse of interconnected games, breaking down the barriers that traditionally separate publishers and platforms.

Argus Labs is committed to open-source development, rejecting the notion that web3 gaming's future should be driven by proprietary software. Currently, they are working on three titles in-house, with the Game Engine still in private beta.

The complexity of crypto gaming is unparalleled, requiring developers to navigate unique challenges. The recent $10 million funding round from VCs underscores the excitement surrounding Argus Labs' ambitious vision.

Aztec's New Chapter in Privacy

I was initially concerned when Aztec announced the discontinuation of ZK Money, a straightforward solution for private on-chain transactions. The recent regulatory landscape has raised questions about the viability of such products. However, Aztec is not shutting down; instead, they are pivoting toward promising developments.

Similar to Argus Labs, Aztec has recognized that Ethereum is an unsuitable foundation for their ambitious goals. They are transitioning to a Layer 2 zk rollup, utilizing a rust-based, privacy-focused framework called Noir. This shift reflects a need for enhanced privacy features that Solidity cannot provide.

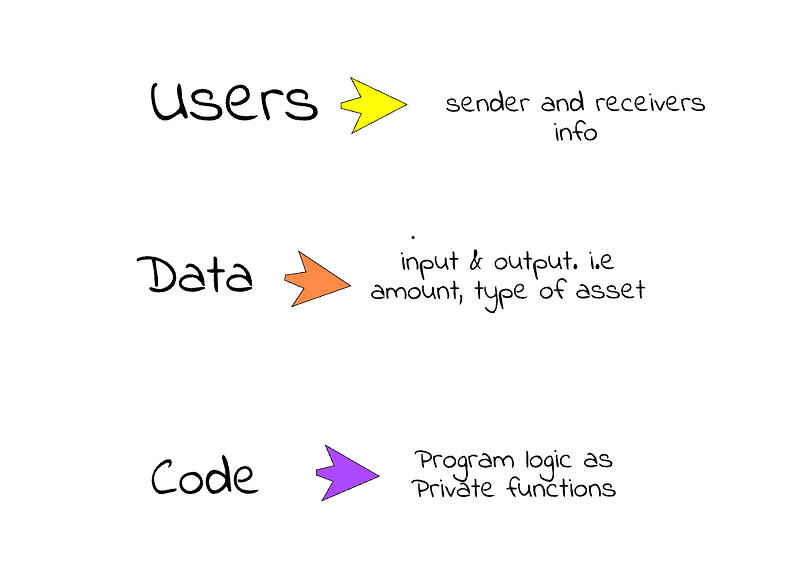

Aztec’s approach to on-chain privacy is comprehensive, aiming not just to shield user transactions but also to protect data and smart contract logic from prying eyes.

Among these three projects, it's challenging to choose which is the most intriguing. Each holds the potential to lead to applications and services that could redefine user experiences in the crypto space. New initiatives like these reignite excitement about the industry's future, offering hope amid a challenging bear market. Exciting developments lie ahead, and there is much to anticipate.

The first video titled "3 Crypto Projects to Watch in 2024!" provides insight into promising projects that could shape the future of cryptocurrency.

The second video titled "How I Find Good Crypto Projects EARLY" explores strategies for identifying emerging crypto opportunities before they become mainstream.