Navigating NFT Payments: A Deep Dive into Credit Card Integration

Written on

Chapter 1: Understanding the Importance of Credit Card Integration

In the evolving landscape of NFTs, integrating credit card payment options is becoming increasingly common. As I delve into various payment processors, I find that providing a reliable credit card option is crucial for enhancing the web3 experience. However, ensuring that the processor has longevity is essential.

The urgency of this consideration comes from the crypto adage, “not your keys, not your crypto.” When offering credit card transactions for NFTs, it usually indicates that the purchaser lacks an Ethereum wallet. Consequently, their NFTs will typically reside in a custodial wallet managed by the credit card provider.

This scenario raises a vital question: what happens if the credit card processing company ceases operations or shifts its focus? If that company holds the keys to the custodial wallets created for credit card minters, the potential for loss is significant. Additionally, who bears the responsibility should complications arise?

It's prudent to ask these questions while assessing potential credit card processors in the NFT realm. The last thing any NFT project wants is for their payment processor to disappear, leaving users without access to their assets. Yet, it’s unrealistic to expect any company to remain operational indefinitely.

For instance, had you possessed your own wallet and keys back in 2017, any acquired free Punks would still be accessible today. Conversely, if you mint the next big NFT using a credit card today and don’t check back until 2030, will you regain access?

To mitigate risks, NFT projects should provide credit card purchasing options while encouraging buyers to familiarize themselves with MetaMask or cold storage solutions. Once users are comfortable, they should be advised to transfer their assets from custodial wallets to personal wallets.

Moreover, it is advisable to establish clear guidelines regarding responsibility. For example, a statement on your website could communicate: “We offer credit card purchases through a vetted processor. However, please be aware that custodial assets like NFTs carry risks over time. We urge holders to learn about wallets and transfer assets to their own wallets promptly.”

With that discussed, let’s turn our attention to NFT Pay. If you're curious about why I opted for NFT Pay, I'll share that at the end of this article.

Section 1.1: NFT Pay’s User Interface for Credit Card Purchases

The interface for NFT Pay appears quite standard. I encountered some minor challenges aligning their code with React, which is to be expected. For my trial, I simply added a button to facilitate credit card transactions.

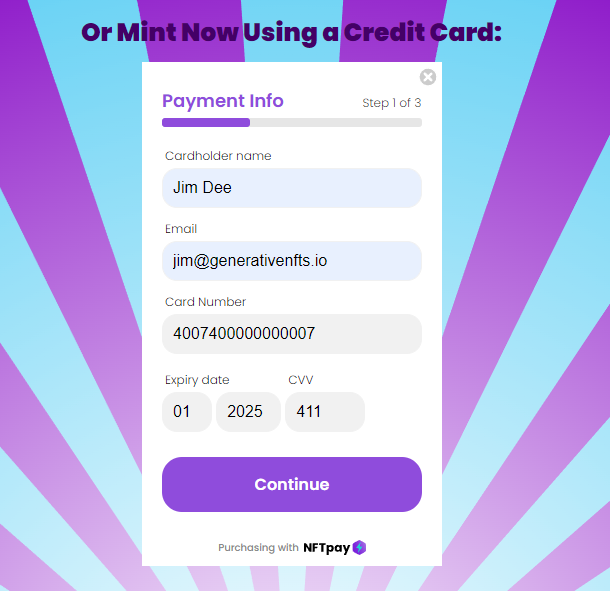

Upon clicking the button, a form appears:

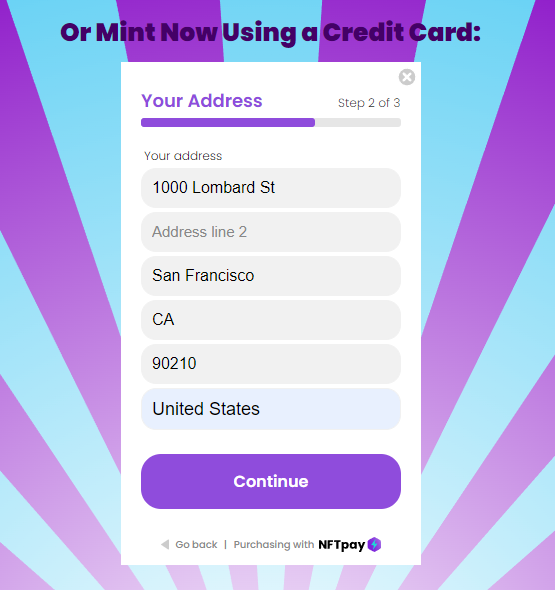

Users input their name and email (using a test credit card number on the testnet), and clicking "Continue" leads to an address screen:

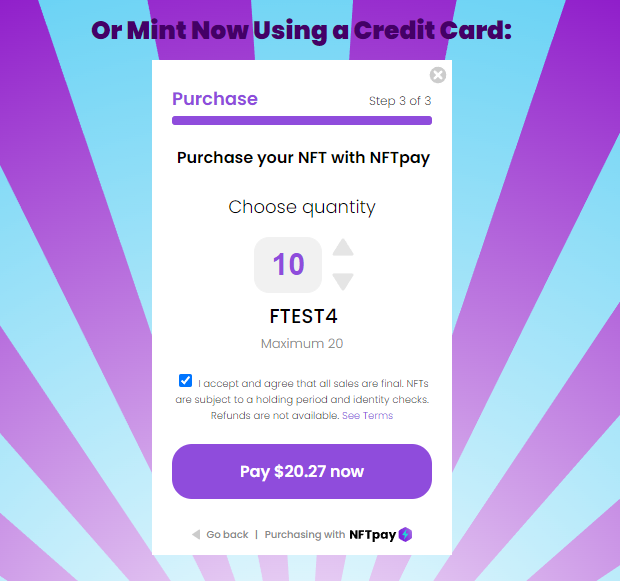

From there, buyers can select quantities, agree to terms, and proceed to payment, which displays the total in USD:

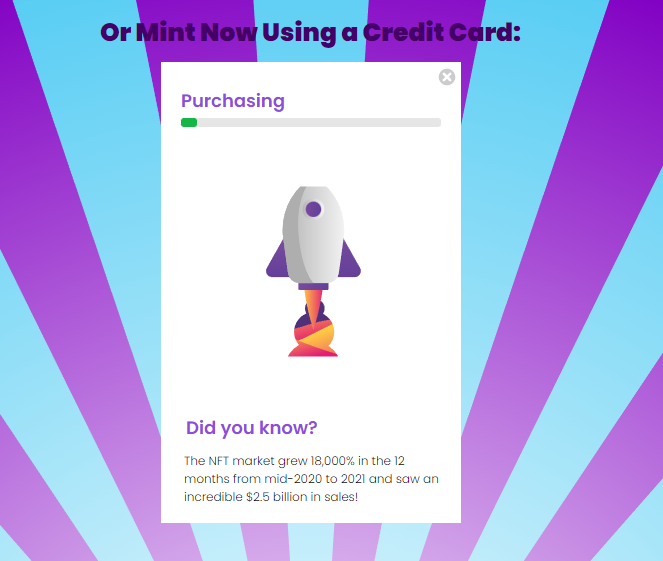

Next, the usual processing screen appears, taking a few minutes as conversions from ETH to USD are processed:

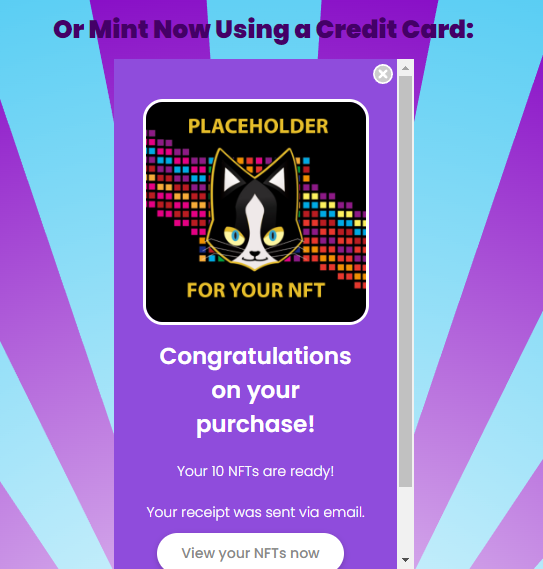

A confirmation screen follows:

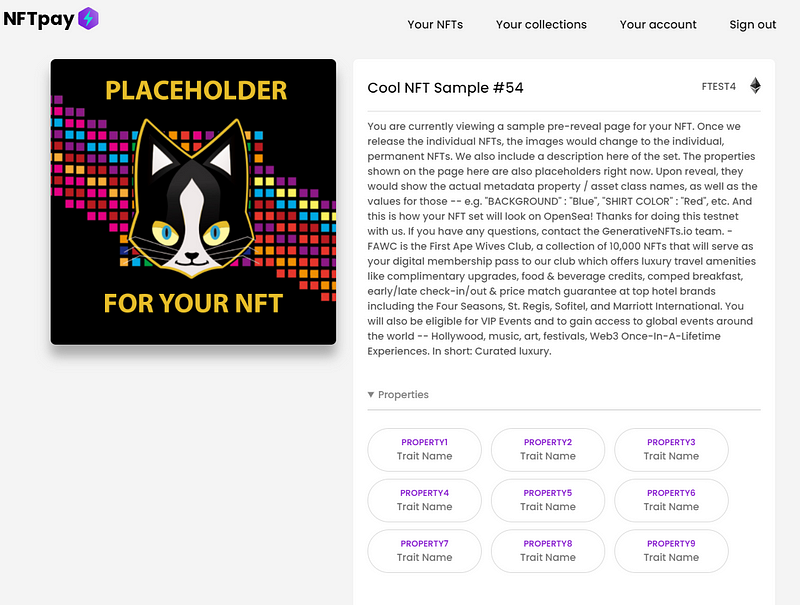

This screen leads to NFTs on their platform:

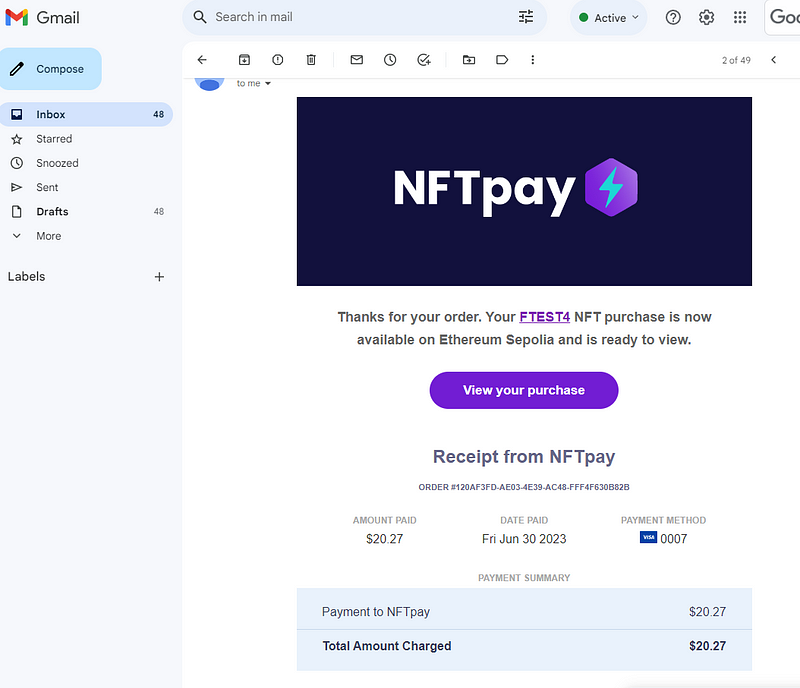

Additionally, an email receipt is sent, containing a link to the NFT custodial wallet on NFT Pay:

It's important to note that transferring NFTs from your custodial wallet on NFT Pay requires completing a KYC check to verify your identity.

This is standard procedure as we navigate the fiat landscape, and details of this policy are presented during checkout.

Section 1.2: Transitioning from Winter to NFT Pay

The team at NFT Pay has been responsive and helpful throughout this process. In contrast, my previous experience with Winter was disappointing due to a lack of communication when I sought assistance while preparing for my current launch.

My attempts to reach out included:

- Sending emails to two staff members without receiving replies.

- Contacting their support team with no response.

- Direct messaging two team members on Twitter, which went unanswered.

- Tweeting at them without any follow-up.

- Attempting to engage on Discord for three days, again with no feedback.

After such an experience, I felt it was necessary to make a change, highlighting the critical points mentioned earlier regarding custodial risks and reliable support.

Jim Dee, a prolific writer and developer based in Portland, shares insights and experiences at JPD3.com. Thank you for reading!

The video titled "Increase Revenue By 10-15% Instantly With One Click Upsell by Zipify Shopify App - Honest Review" provides valuable insights on enhancing revenue through effective upselling strategies.