The Most Significant Financial Mistakes in History

Written on

Chapter 1: Introduction to Financial Blunders

Everyone experiences financial missteps, whether through impulsive purchases or unwise investments. In this section, we will delve into some of the most notable errors that might evoke a sense of discomfort. From missed opportunities to negligence in high-stakes situations, we'll discuss major blunders that have likely left lasting regrets.

Section 1.1: Quaker Oats’ Costly Acquisition of Snapple

In 1994, Quaker Oats made a significant error by purchasing Snapple for $1.7 billion, thinking they could replicate Gatorade's success with the brand. Just two years later, they sold Snapple for a mere $300 million, resulting in a staggering loss of $1.4 billion. The core issue stemmed from Quaker’s attempt to combine Snapple’s distribution with Gatorade’s, upsetting Snapple’s independent distributors who were earning more from their existing contracts. Quaker underestimated the complexities of Snapple’s distribution system and failed to recognize declining sales prior to the purchase, leading to a painful financial lesson.

Section 1.2: A Clerical Error That Cost Millions

A clerical blunder in the UK resulted in a $9 million lawsuit for the government. This mistake involved the erroneous declaration of Taylor and Sons as being in liquidation, rather than the correct title, Taylor and Son. Consequently, more than 250 workers lost their jobs when the 124-year-old family business faced bankruptcy due to this mix-up, showcasing how a simple clerical error can have dire consequences.

Chapter 2: Missed Opportunities in Publishing

The first video titled "5 Biggest Mistakes Of All Time" explores monumental errors across various fields, including publishing.

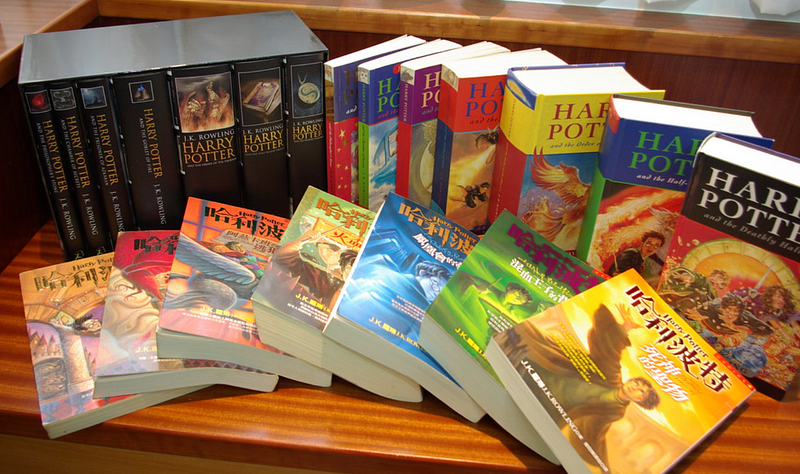

Section 2.1: The Rejection of J.K. Rowling

J.K. Rowling faced numerous rejections before her Harry Potter series gained traction, with 12 publishers dismissing her work. They underestimated her potential, believing that readers wouldn’t embrace a female author. Rowling, however, persevered and eventually found a publisher willing to take a chance on her story, leading to the phenomenal success of the Harry Potter franchise. The missed opportunity for those initial publishers turned out to be a significant oversight, as Rowling's works became globally acclaimed, making her a billionaire.

Chapter 3: Tech Blunders and Lost Fortunes

The second video titled "15 BIGGEST Business MISTAKES In History" dives into crucial blunders in the business sector.

Section 3.1: The Bitcoin Hard Drive Incident

In 2013, IT engineer James Howells mistakenly discarded a hard drive that contained the private key for 7,500 bitcoins, now valued at over $315 million. During a cleanup, he believed the drive was empty, resulting in a significant loss. Despite the passing years, Howells remains hopeful about retrieving the bitcoins, needing permission from local authorities to search a landfill where he believes the hard drive may be located.

Section 3.2: The Japanese Trader's Massive Error

In one of the largest trading blunders on record, a Japanese trader accidentally placed orders for 610,000 shares at an astonishingly low price of 1 yen each, culminating in a total value of 67.78 trillion yen (approximately $617 billion). This “fat finger” incident was quickly reversed, but it raised concerns about trading protocols and the checks in place to prevent such errors.

Conclusion: Lessons Learned from Financial Mistakes

These financial blunders serve as crucial learning experiences. From missed opportunities to trading errors, they illustrate how minor oversights can have profound consequences. Making mistakes is an inherent part of life, but it's vital to strive for excellence to minimize regrets in our financial decisions.